what is an example of an ad valorem tax

Ad valorem taxes are commonly used with real estate personal property or other goods and services. Real estate taxes and sales taxes are common examples.

Tax Rates Gordon County Government

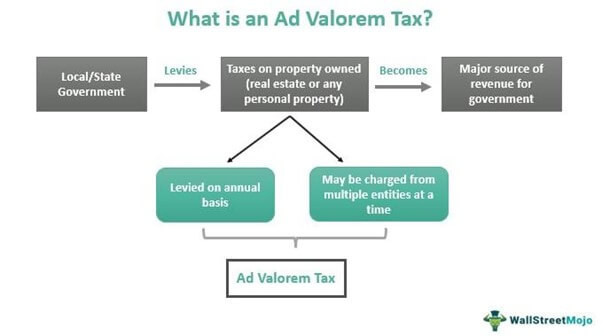

An ad valorem tax is a tax that is based on the assessed value of a property product or service.

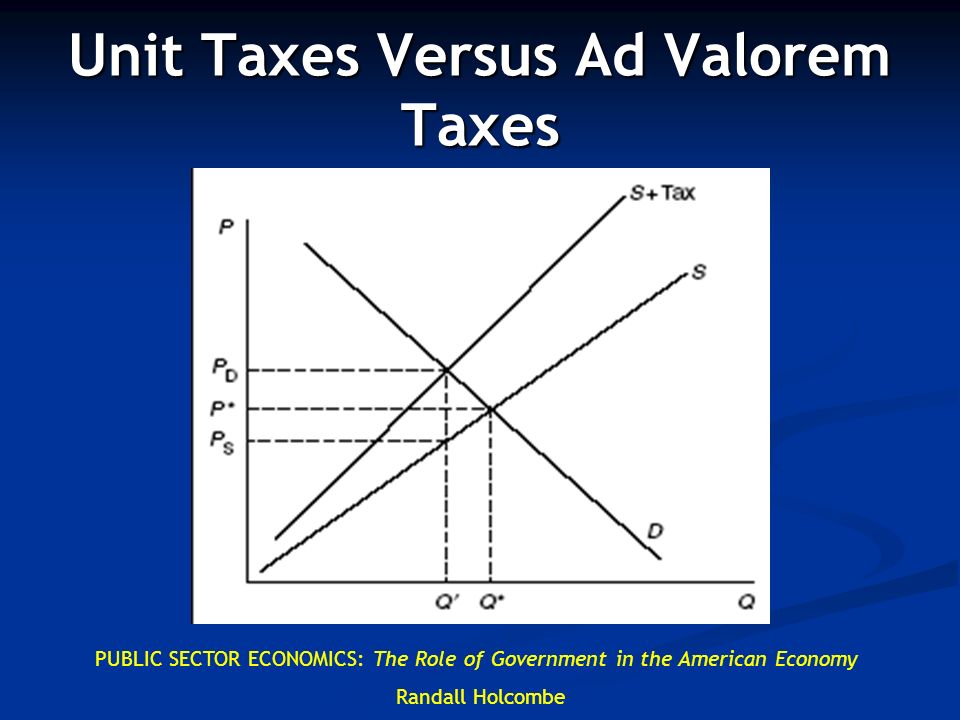

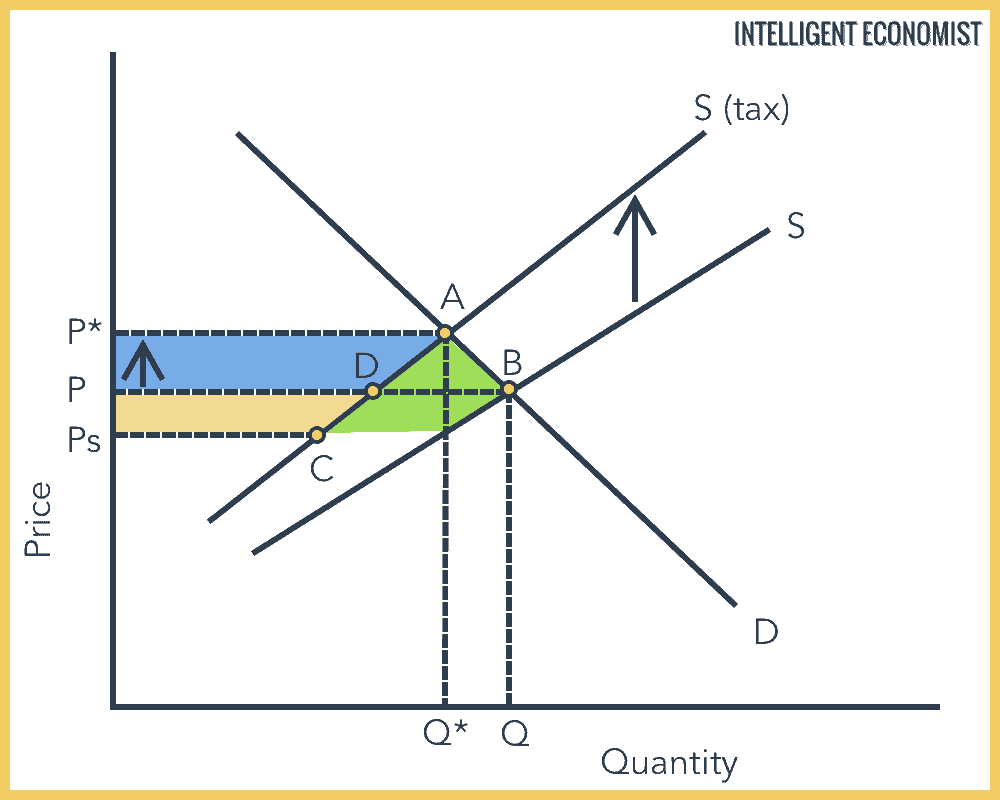

. An ad valorem tax is expressed as a percentage. The most commonly used ad valorem tax for assets is the property tax while VAT and sales tax are common. A 20 ad valorem tax increases production costs by 20 at.

The most common example of ad valorem tax is property taxes. Tax Planning Tips for. The most common ad valorem tax.

AdT are usually charged by municipal and state government authorities. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Imports are charged 8 exports 1 ad valorem duty.

An ad valorem tax is a tax that is based on the assessed value of a property product or service. The most common ad valorem tax examples include property taxes on real. For example VAT is charged at a rate of 20 in the UK.

The most common ad. About 4000 were thus annually imported and an. An ad valorem tax is a tax that is based on the assessed value of a property product or service.

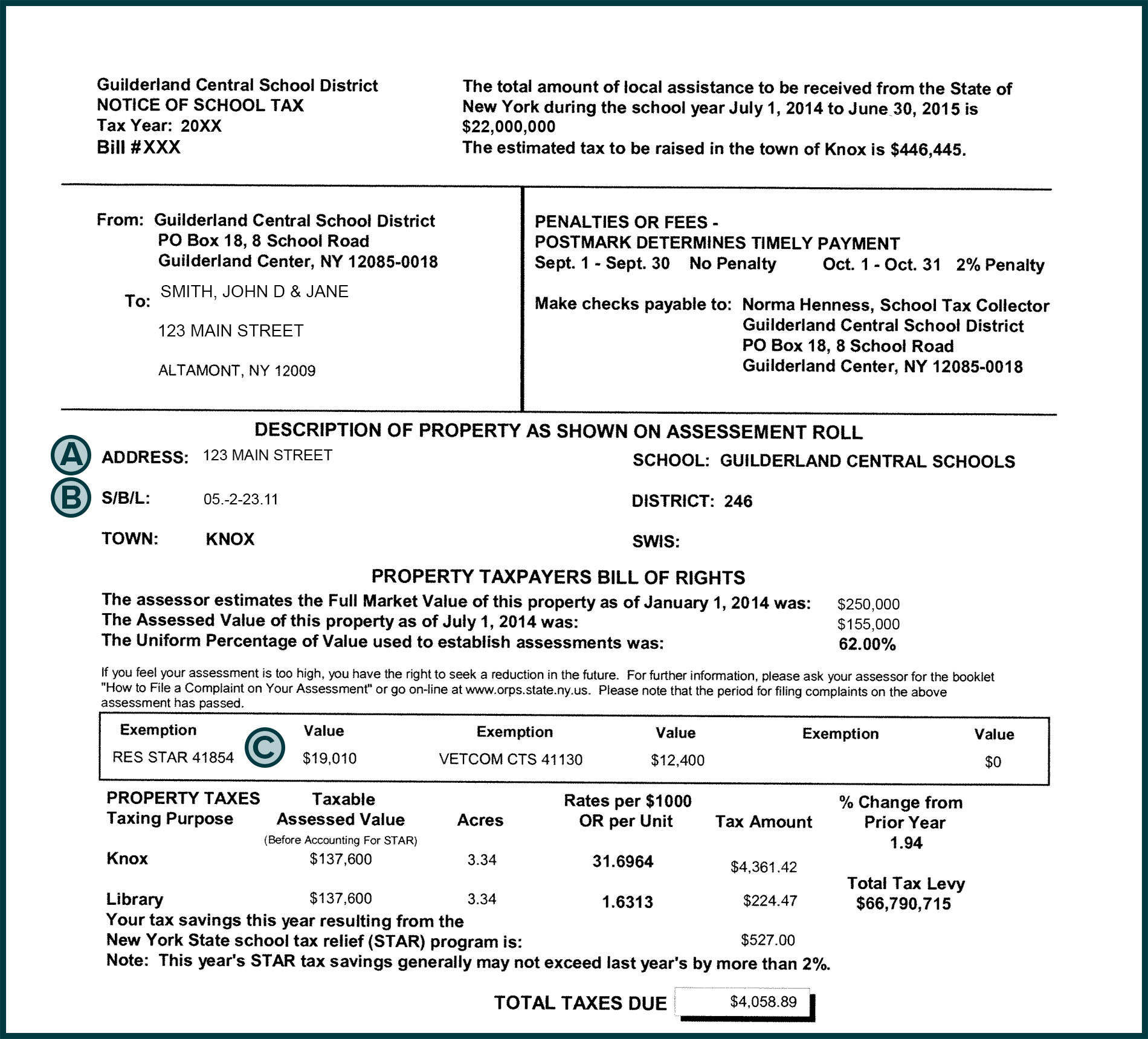

An example of an Ad Valorem Tax Property tax is a form of ad valorem tax levied on the value of the real estate or other residential and commercial properties paid by the. An ad valorem tax is a tax that is based on the assessed value of a property product or service. What is an example of an ad valorem tax is.

An ad valorem tax is a tax that is based on the assessed value of a property product or service. The most common ad. Once the value is determined the owner is taxed accordingly.

What are the types of ad valorem tax. An ad valorem tax is any tax assessed based on the value of an underlying property or transaction. Ad valorem sentence example.

Ad valorem tax examples. Local government entities may levy an ad valorem tax on real estate and other major personal property. How much will taxes be on my car.

Ad Valorem Tax. What is an example of an ad valorem tax is. For example if this tax is applied to the value of a property every year the tax burden will.

An ad valorem tax allows to easily adjusting the amount to be paid in any given occasion. The most common ad valorem tax examples include property taxes on real. A good example of the ad valorem tax is a local property tax which is assessed annually on the value of an owners residence and property.

One of the most common examples of an ad valorem tax is property tax. 3 Examples of Ad Valorem Taxes. You are essentially paying ad valorem taxes when youre paying your home property tax as it is based.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. The most common ad valorem tax examples include property taxes on real. Ad Valorem Tax Meaning This tax requires an appraise to value a household or land on a periodic basis.

Which of the following is an example of an ad valorem tax.

Excise Taxes Unit Taxes Ad Valorem Taxes Ppt Video Online Download

Ad Valorem Tax Explained Budgetable

Understanding Your Property Tax Bill Department Of Taxes

Excise Tax Definition Types And Examples Thestreet

Indirect Tax Intelligent Economist

Office Of The Treasurer Tax Collector Understanding Your Tax Bill

Yet Another Source Of Inequality Property Taxes Federal Reserve Bank Of Minneapolis

Understanding California S Property Taxes

Tangible Personal Property State Tangible Personal Property Taxes

Ad Valorem Tax Meaning Types Examples With Calculation

:max_bytes(150000):strip_icc()/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)

Ad Valorem Tax Definition And How It S Determined

What Is An Ad Valorem Tax 2019 Robinhood

What Is Ad Valorem Tax Advalorem Tax What Is Specific Tax Ad Valorem Tax Vs Specific Tax Urdu Hindi Youtube

Understanding California S Property Taxes