bid to buy ask to sell

So a market maker puts in a bid when he wants to buy but the trade only. If you buy the ask this is a limit order at the best ask price.

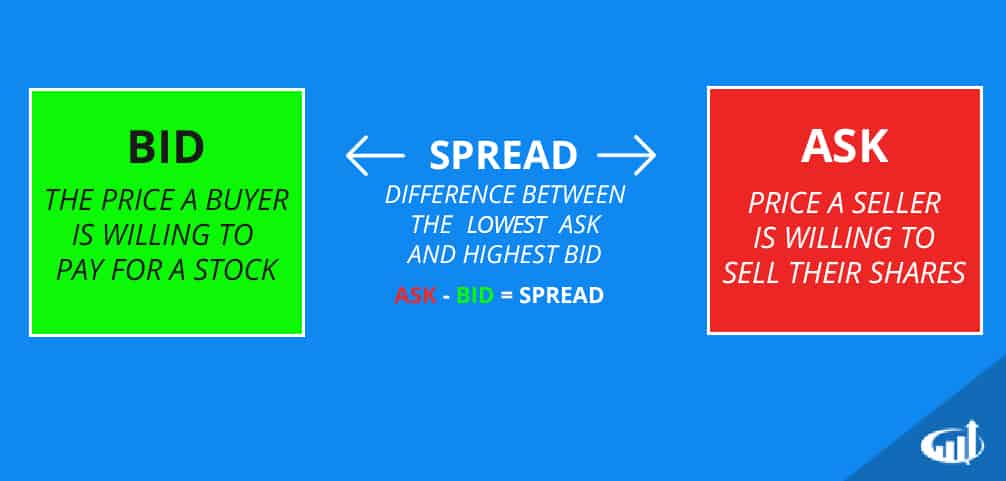

The bid-ask spread is the price difference between what buyers are willing to pay the bid and what sellers will accept the ask for something.

. The ask the lowest price at which any market participant has. So you just place limit order and wait for. You can not buy at Bid price.

This article at a glance. It is a key dynamic behind every. If you are looking to buy into a stock using a market order you will fill at the ask price.

Only a desparate seller can sell at Bid price. Both prices respond to the supply and demand. Ask is the price a seller is willing to sell an asset for.

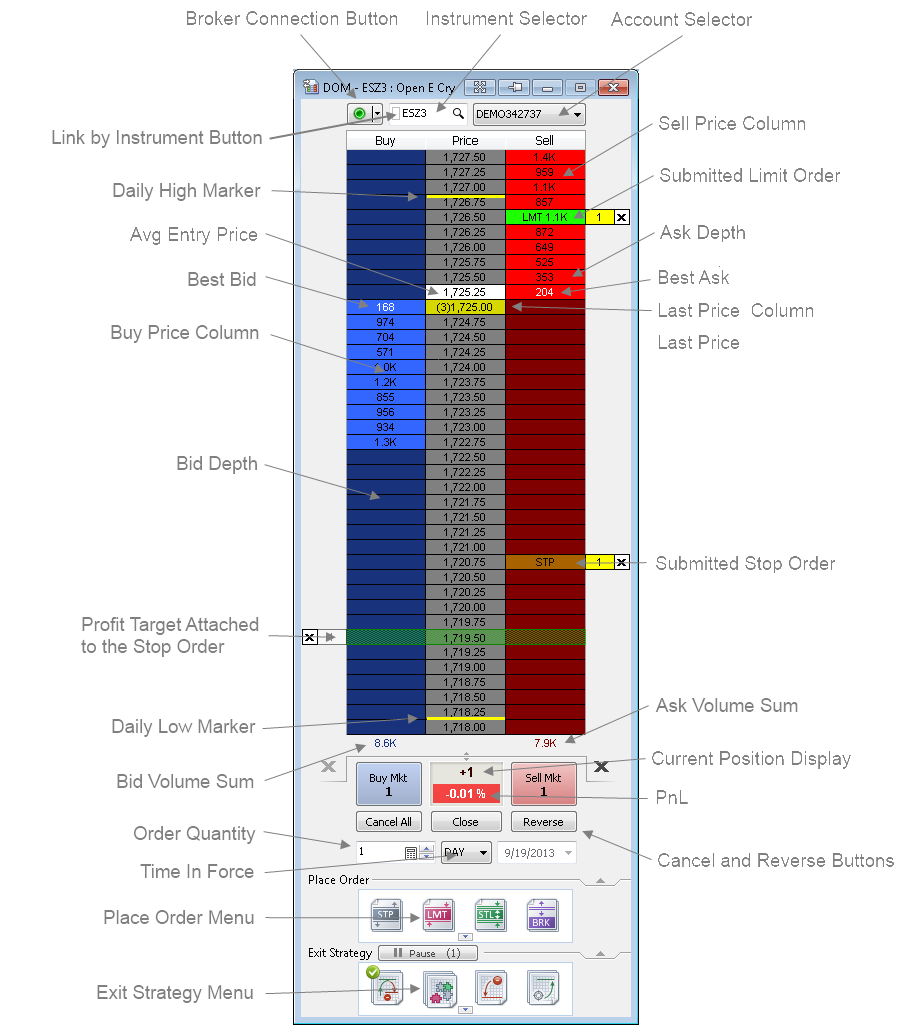

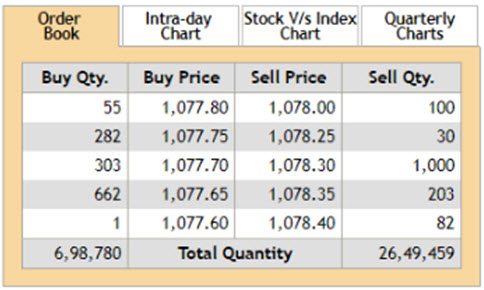

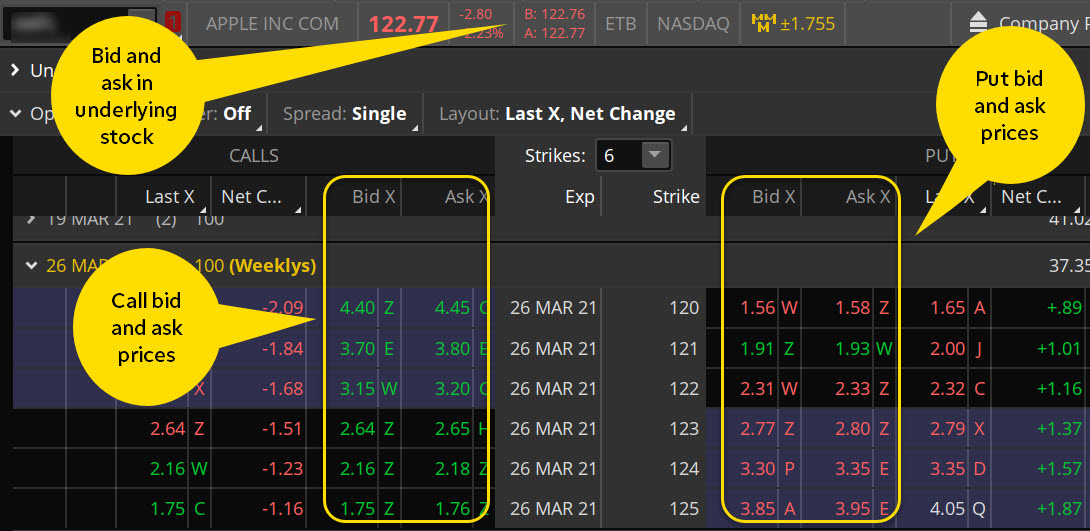

As per the bid and ask price. The bid size and ask size represent the number of stock or other securities that traders are willing to buy or sell at a certain bid price or ask price. When you put a request to buy a stock at a certain price you are placing a bid.

Answer 1 of 3. Buy ask is an aggressive order that matches the ASK where you expect a quick execution. Sellers will now see 1132 and depending on their eagerness to sell may lower their price to meet.

As a trader it is vital to understand what the bid and ask are and how placing orders can affect your trade executions. This is usually represented in. This is true for all limit orders.

The price is guaranteed but there is a risk of not getting filled. Except there are millions of traders buying and selling thousands of different stocks every day. A decent understanding of the bid and.

Bid and Asked. Your order of 1132 would now replace the current bid offer of 113167. Kaufman Realty Auctions of WV.

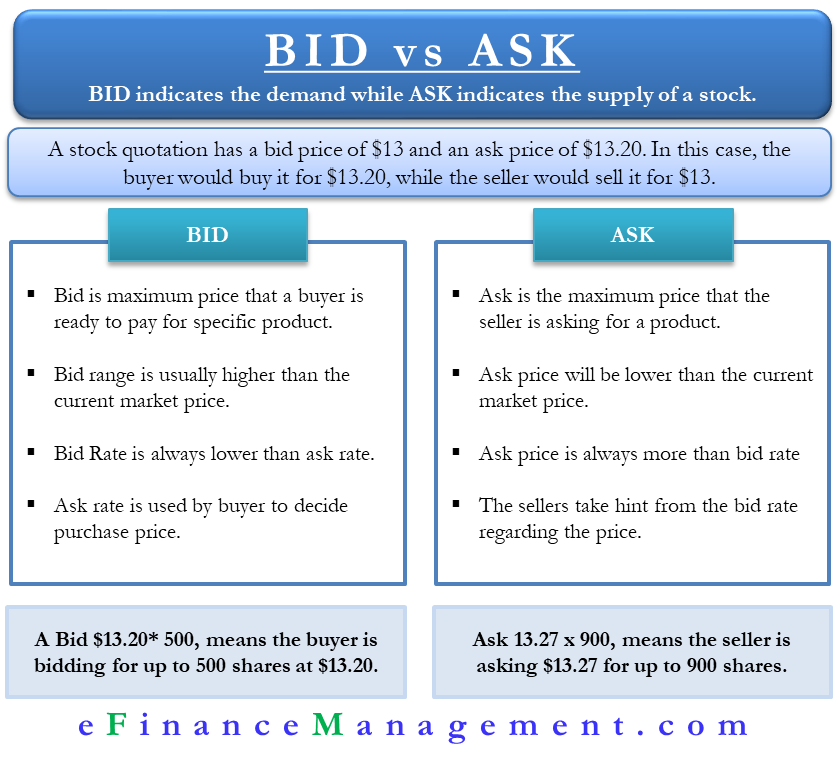

Lets assume that a broker is. Bid and Ask is a two-way price quotation that indicates the best price at which a security can be sold and bought at a given point in time. The bid the highest price at which any market participant has expressed a willingness to buy the product.

This is exactly how bid and ask work on the stock market. Buy Bid will enter a buy order to match the bid which requires the sellers to. Bid is the price a buyer is willing to pay for an asset.

Bid price represent the price buyer is willing to pay for the stock. The bid size and ask size represent the number of stock or other securities that traders are willing to buy or sell at a certain bid price or ask price. At its core bid is the.

Firearms Ammo Knives Hunting Supplies. Spread is essentially a small cost built into the bid and ask prices offered by a broker to buy or sell a currency. The bid vs ask represents the prices that buyers are willing to pay bid and what prices the sellers are willing to sell at ask.

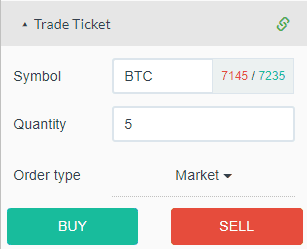

As per the bid and ask price in the above image sellers will pay 092388 to sell while buyers will pay 092406 to buy the trading asset. To understand why there. To answer this question we need to understand what bid and ask prices actually are.

Bid to buy ask to sell. Understanding The Bid-Ask Spread.

Bid Ask Interpreting Buying Selling Pressure In Trading Tradingsim

Depth Of Market Dom Multicharts

Bid Price Vs Ask Price Top 7 Best Differences With Infographics

Bid Ask Spread What It Is How It Works Seeking Alpha

Bid Vs Ask All You Need To Know

The Private Banker Bid Ask Trading Glossary

Executing An Options Trade Navigating The Bid Ask Sp Ticker Tape

Bid Ask Spread Formula And Calculator

Anyone Can Help Me Understanding Subtle Difference Between Buy The Ask And Join The Bid R Daytrading

Bid Ask And Spread Level 2 Day Trading Strategies

Why Does The Chart Trader Order Entry Window Have 4 Buy And Sell Buttons Ninjatrader Support Forum

Order Flow Fundamentals In Futures Trading Explained Step By Step

Breaking Down The Payment For Order Flow Debate

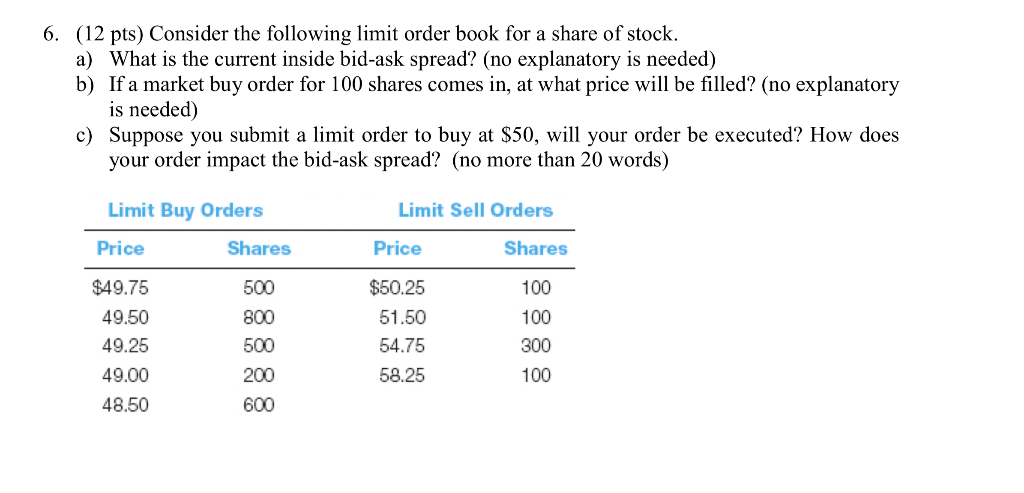

Solved 6 12 Pts Consider The Following Limit Order Book Chegg Com

Bid Price Vs Ask Price Top 7 Best Differences With Infographics

Bid And Ask Definition How Prices Are Determined And Example

Bid Ask Spread Definition Forexpedia By Babypips Com

Bid Ask Spread Everything Traders Need To Know Shifting Shares